Ways To Get A Virtual Credit Card Number. When you shop online, you run the potential danger of giving hackers access to the credit card number you use. If something like this occurs, you won’t have to worry about paying for any erroneous charges thanks to the protection offered by your credit card, but it will still be a major inconvenience. It may take a number of phone calls and letters to the company that issued your credit card before the issue is resolved.

Utilizing a virtual credit card number is one approach that can be taken to circumvent the issue. This is a one-of-a-kind number that is associated with your credit card account and serves as a replacement for your actual card number when you are checking out. If a thief gets their hands on it, they won’t be able to utilize it because it only has a limited amount of use.

READ ALSO: How To Save Money On House Insurance

There is a significant difference between a virtual credit card number and a payment software such as Apple Pay or Google Pay. With the help of these solutions, you’ll be able to use your actual credit card information when making digital payments in traditional businesses as well as online. The use of a virtual card is limited to online purchasing and does not include transactions made using a shopping app.

The most effective method to Get a Virtual Charge card Number

The simplest method for getting a virtual Visa number is through the card guarantor. In any case, in the event that your Mastercard organization doesn’t offer this component, there are some outsider devices that do.

1. Your Charge card

A couple of Visa backers offer virtual record numbers for their cardholders, for nothing. It’s to their greatest advantage to do this, since shielding your card from robbery likewise safeguards them. All things considered, they’re the ones eventually on the snare for paying any false charges.

Card backers that offer virtual numbers include:

American Express. AmEx offers virtual numbers for its business cards, including Blue Business Money and Business Platinum. The essential record holder can utilize American Express Go to make virtual cards for workers and set spending limits for each card.

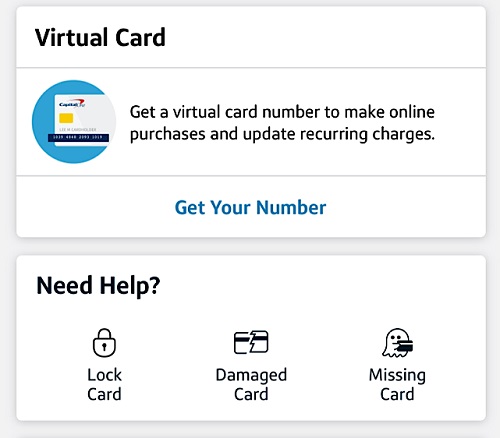

Capital One. Virtual record numbers are accessible for all Capital One charge cards. You can set one up through Eno, Capital One’s advanced associate. This element is accessible just through the Eno program augmentation in Chrome or Firefox, not the Eno portable application.

Citibank. Citibank offers virtual record numbers just for chosen Mastercards. With the Citi Chief and Citi Precious stone Favored cards, you can produce a virtual Visa number right from your record landing page. With the Citi Twofold Money card, you should begin the landing page and drill down through “Different Administrations” menu.

X1. The new X1 Card offers the capacity to create a collection of virtual Mastercard numbers for a solitary record. You can make and utilize many cards on the double and give each card its own lapse date. This component is helpful for things like preliminary memberships, since you can set a card to lapse before the free time for testing closes.

2. Apple Card

The Apple Card is a Mastercard exceptionally intended to work with computerized installments. At the point when you join, you get three separate Visa numbers:

A number for your actual card

A number for Apple Pay exchanges made through the Apple Wallet application

A virtual Mastercard number for online buys and in-store buys from traders who will not acknowledge Apple Pay

You can find your virtual record number in the Wallet application on any Apple gadget. In the event that your number is at any point compromised, you can get another one immediately. This doesn’t slow down the utilization of your Apple Wallet or your actual card.

3. Google

Google clients can utilize their Google Records to create virtual Visa numbers for qualified U.S. credit and charge cards. This isn’t a similar component as the Google Pay application, and you needn’t bother with Google Pay to utilize it.

At the point when you save a qualified credit or check card to your Google Record, you have the choice to turn on the virtual card number element. When you do, you will have the virtual card accessible as an installment choice at checkout for on the web and in-application buys.

You can likewise turn on virtual record numbers when you make a buy on an Android gadget or in the Chrome internet browser. This possibly works in the event that you select a qualified acknowledge or charge card as your installment technique at checkout.

4. Snap to Pay

Anybody with a significant Mastercard can utilize a virtual charge card number through the free help Snap to Pay. At the point when you use Snap to Pay, your genuine card number is stowed away from the shipper and from anybody sneaking around on the web.

To utilize Snap to Pay, follow these means:

Sign into Snap to Pay through your charge card organization: Visa, Mastercard, American Express, or Find.

Enlist your card by entering your name, email, charging address, and card subtleties.

At the point when you see the Snap to Pay logo on a site, click the button to get a six-digit security code on your telephone or other gadget.

Enter that code on the site to get to Snap to Pay.

Assuming that you have more than one card signed up for Snap to Pay, select which one you need to utilize.

Snap to Pay is just accessible on specific sites. Nonetheless, there are north of 10,000 web-based retailers who use it.

5. Security

Security is an outsider stage that allows you to make a virtual record number from your program. In any case, there’s a wind: the number is connected to your financial balance, not your charge card account. The cards are really virtual charge cards instead of virtual Visas.

Security is accessible as an iOS or Android application or as a program expansion for Chrome or Firefox. The help has three evaluating levels. With the free Private help, you can:

Make up to 12 virtual Visas a month.

Put together your cards in a computerized wallet and label them for simplicity of arranging.

Make and auto-fill a protected card number at checkout with a single tick through the program expansion.

Set spend limits for a card exchange so that any sum over the breaking point is naturally declined. This component safeguards you from stowed away expenses and twofold charges on repeating installments.

Add an additional layer of insurance by making secure Protection Cards that main work with one shipper. Assuming that that trader’s client records are at any point uncovered in an information break, your card number won’t work elsewhere.

Track your spending in the Record Outline dashboard.

The Master level, which is reasonable for independent ventures, costs $10 every month. It allows you to make up to 36 virtual cards each month and gives you need admittance to client service. It likewise permits you to make 1% money back on up to $4,500 worth of qualified exchanges every month.

The $25-per-month Groups level is for greater organizations. It surrenders you to 60 virtual cards a month and committed account the board.

6. Otto

Otto is an installment device that assists you with overseeing repeating month to month charges and subscriptions.You can involve it to sort out the entirety of your bills and memberships in a single put and pay them consequently on a timetable that works for you.

With Otto, you can make limitless virtual charge cards at no expense. This empowers you to set an alternate card with an extraordinary number for each charge you get. On the off chance that one card number is uncovered, the others are protected. You can freeze or drop any card immediately without influencing the others.

Otto’s virtual charge cards incorporate custom month to month spending cutoff points and custom termination dates. This can assist you with planning by giving you a limited add up to spend in each spending plan class. You can likewise make unique Free Preliminary Cards to exploit preliminary memberships without chance of being naturally charged for a reestablishment.

7. Revolut

Revolut is a generally useful application for spending, saving, and putting away cash. It’s a pre-loaded check card, online investment account, and crypto trade across the board. What’s more, one of its key highlights is virtual record numbers.

You can utilize a virtual Revolut card to make on the web or in-application buys or to shop in a store with a portable installment administration like Apple Pay or Google Pay. Revolut offers two sorts of virtual cards:

Reusable cards that you can store and use again and again while keeping your genuine card subtleties stowed away

Expendable virtual cards that work just a single time, giving an additional layer of security

Be that as it may, not all Revolut clients approach this element. Like Security, Revolut has a few levels of administration: the free Standard Help, Premium for $9.99 every month, and Metal for $16.99 per month. Just the main two levels offer virtual card numbers.

To make a virtual card in Revolut Premium or Metal, open the “Cards” segment inside the application and swipe through to “Get New Revolut Card.” Select “virtual card” and pick between Virtual (multi-use) and Expendable Virtual (single-use). Then, at that point, you can utilize your new virtual card very much like a customary Visa.

8. Payoneer

Payoneer is a stage for sending and getting installments universally. Helpful for consultants work with clients abroad and for online business merchants who sell their items in far off nations.

One component of Payoneer is the capacity to arrange Payoneer Cards — physical or virtual.

These cards are connected to your Payoneer account and can make installments from it in any cash you pick. Payoneer Cards work anyplace Mastercard is acknowledged: at ATMs, in stores, and on the web.

To utilize Payoneer cards, you probably got no less than $100 in installments to your Payoneer account in the beyond a half year. This does exclude installments produced using e-wallets like PayPal, so you can’t just send yourself cash to become qualified.

Making a virtual card is free, yet there are expenses for certain kinds of installments. You can make separate Payoneer Cards for various monetary standards, yet you can have one for some random money. Whenever you’ve made a card, you can utilize the “Card top-up” component to have any assets from your Payoneer account that are in that money move to the card naturally.

To arrange a virtual card, sign in to your record and navigate the “Banks and cards” menu to “Payoneer cards.” Snap on “Request a card,” select “Virtual,” and set the money. At long last, enact your card by means of the “Card The board” menu prior to utilizing it.

9. Zeta

Zeta is an internet based bank that takes care of couples. Its center component is a joint ledger with two connected cards, one for each accomplice. What’s more, notwithstanding their actual card, every client consequently gets a virtual card for online use.

To utilize your Zeta virtual card:

Open “Settings” in the iOS or Android Zeta application.

Look down to Virtual Cards and select your card.

Flip the card on to utilize it.

At the point when you’re finished, you can flip the card ease off to prevent any other individual from utilizing it.

On the off chance that your virtual Zeta card is at any point compromised, you can erase it and make another one.

Summary

It is not necessary to make a payment in order to obtain a virtual credit card number. If the company that issues your credit card does not offer this capability, you can simply obtain it through the use of a free service such as Click to Pay or Otto. A subscription service, such as Privacy or Revolut, is only worth signing up for if you require the use of the service’s additional capabilities.

When you shop online, using virtual credit card numbers is a helpful approach to safeguard the information associated with your credit card account. However, they are not without their restrictions. They are unable to protect you from other types of identity theft, such as a thief opening new accounts in your name using your Social Security number.

Therefore, you should consider virtual account numbers to be merely one of the instruments in your arsenal for protecting your privacy. Combining these measures with additional safeguards, such as robust passwords, anti-virus software, firewalls, and routinely reviewing your credit report for indications of fraudulent activity, is the best way to ensure your safety.